By Timothy Kelly

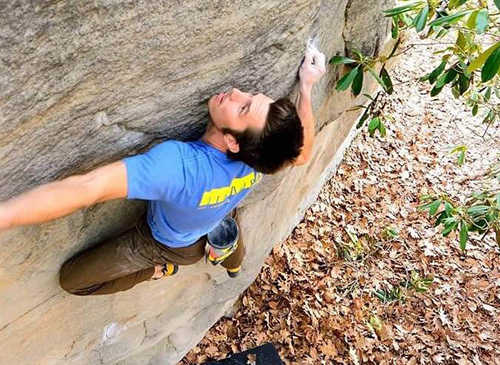

EnergyCAP headquarters in Boalsburg, PA. Photo by T. Kelly

EnergyCAP headquarters in Boalsburg, PA. Photo by T. Kelly

Is private equity ruining economic development? That’s the premise of a new book that offered a critical — to put it mildly —portrayal of private equity. “The titans call their industry private equity,” Gretchen Morgenson and Joshua Rosner wrote in “These Are the Plunderers: How Private Equity Runs―and Wrecks―America.” “They are not entrepreneurs… prospering while creating jobs and opportunities for others.”

For three local companies, we heard a different story.

Private equity investors invest in mature companies in order to grow a company’s value and sell their stake for a profit, usually within three to seven years. We’ve featured a host of Happy Valley companies that have received private equity investment in the last several years, so we circled back to see how it’s going. Each of these companies is in the middle of their private equity journey. Here’s what they had to say.

What lessons did you learn?

Steve Heinz is the founder and board member of EnergyCAP, LLC. He said, “The number one thing, the very first thing I would say to any business owner is to start the thought process early, at least five years in advance.”

Private equity has produced jobs, developed solar power, and is opening the door for employment in the life sciences industry in Happy Valley.

Jim Echard is president of the BAI Group, LLC, (BAI) a local consulting firm providing services to entities engaged in environmental development projects. Echard cautioned that just because a company gets an infusion of cash doesn’t mean it’s going to grow.

Ted Liberti, Chief Commercial Officer and Cofounder of BioMagnetic Solutions, LLC, said, “You’ve got to be strategically flexible,” and watch for opportunities to capitalize on. He also said the company’s Centre County location “was a big part of helping us make a dollar stretch.”

What was the state of the business before private equity?

Echard said that BAI was experiencing about two percent annual growth and looking for ways to grow the company. BAI closed with Symmetrical Investments, LLC, in March 2018.

Before establishing a strategic partnership with private equity investment firm Resurgens Technology Partners, Heinz said the business was strong, with 10%-12% year-over-year growth and no debt. “We had a committed staff and we had very committed customers who gave us high marks. So I think the business was very healthy at that point,” he said.

Biomagnetic Solutions was in a unique position, being much earlier in their development. The company was built up with corporate funding and grants and needed more to accomplish big goals.

Home of BioMagnetic Solutions’ new cleanroom production facility at Innovation Park. Photo by T. Kelly

Home of BioMagnetic Solutions’ new cleanroom production facility at Innovation Park. Photo by T. Kelly

What prompted the company to seek private equity?

Heinz said there were two main reasons EnergyCAP engaged with private equity. One was his retirement. “I turned 65 in 2019 and of course as any owner of a business knows, at some point… it’s time to turn it over,” he said. “The other thing was I felt that we had gotten to the point with our products and with our reputation… that we really could make a much greater impact nationally and worldwide through accelerated growth.”

Echard said that BAI was looking to grow through the strategic acquisition of companies offering complementary services.

Liberti said that while BioMagnetic Solutions had released several products already, they had a new product that “needed a financial muscle to get into this market.” The company closed a deal with Gamma Biosciences in January 2021.

What changed at the company after receiving private equity?

Echard said that despite having plans to make strategic acquisitions, “ultimately those didn’t pan out for one reason or another.” Fortunately, Symmetrical Investment was willing to work with him to explore other growth options. BAI sought to meet the needs in the underserved 250 kilowatts to two megawatts (MW) solar power niche occupied by small businesses, schools and local governments. Symmetrical Investment provided guidance and connected BAI to financing expertise. As a result, Echard estimated BAI’s solar energy business revenue grew by 10 times from 2020 to 2021. And BAI has become a trusted partner to energy companies developing 20 MW to 100 MW solar arrays in the Mid-Atlantic as well.

You’ve got to be strategically flexible and watch for opportunities to capitalize on. Centre County location was a big part of helping make a dollar stretch.

Heinz said the private equity firm brought in a team “whose sole mission is to grow the value and the impact of the company.” He continued, “Our growth rate more than doubled… our impact around the world for energy reduction and carbon reduction has really been multiplied.” All that translates to “a much greater environmental impact in a positive way,” Heinz concluded.

For BioMagnetic Solutions, Liberti said that Gamma Biosciences brought leadership expertise, connections to government and industry, and the ability to bring new products to market with the soon-to-be-completed cleanroom production facility at 310 Innovation Boulevard in Penn State’s Innovation Park.

The verdict on private equity in Happy Valley?

So is private equity actually helping to grow production in Happy Valley? In a word, yes. “Our employee headcount in two years is up about 60%,” Heinz said about EnergyCAP. Echard at BAI concurs, reporting that it has multiplied the positive impact of solar for clients across PA.

BioMagnetic Solutions is getting ready to open a $10M facility in Innovation Park and is soon launching a product that can be operated by someone with minimal training. “You don’t need a Ph.D. to operate it,” Liberti said, “That makes it scalable in terms of labor.”

All told, private equity has produced jobs, developed solar power, and is opening the door for employment in the life sciences industry in Happy Valley. If that’s not “providing jobs and opportunities for others,” what is?