By Neave Doherty

Current Penn State student majoring in Finance, Smeal College of Business

Since returning to the presidency on January 20, 2025, Donald Trump has enacted a series of aggressive economic policies including universal tariffs, a federal hiring freeze, and a rollback of clean energy initiatives. While presented as pro-growth, many economists see these moves as intentionally slowing the economy — creating a setup for deep Federal Reserve rate cuts later this year.

Yesterday April 8, 2025, the White House confirmed it will impose a 104% tariff on Chinese electric vehicles, starting at midnight last night— the most extreme action in the administration’s trade strategy so far. Stocks, which had opened higher on rate cut hopes, sold off into the close, with all three major indexes ending the day in the red.

This combination of market volatility and policy escalation adds new urgency to the question: Is a short recession being engineered to create the conditions for an economic and political rebound in 2026?

Strategic Slowdown: A Precursor to Stimulus?

A brief, controlled downturn in 2025 could justify interest rate cuts of up to 200 basis points — opening the door to looser credit conditions and rising asset prices heading into next year’s election cycle.

For regions like Central Pennsylvania — and institutions such as Penn State University — these shifting macro dynamics could bring funding challenges and labor market disruptions if federal research dollars or job creation slow in tandem with demand.

The Trump Economic Playbook: Apply Pressure, Then Pivot

Tariffs Reach New Extremes

As of midnight, a new 104% tariff on Chinese electric vehicles will take effect, according to a White House statement released yesterday. That follows the blanket 10% tariff on all imports and the existing 60% tariff on broader Chinese goods implemented in February.

These moves significantly raise the cost of imported goods and risk retaliation from trading partners. While meant to protect U.S. industry, they also increase input costs, fuel inflation, and erode margins in sectors like auto, tech, and consumer electronics — all while slowing consumption.

Federal Hiring and Spending Freeze

A January executive order froze most discretionary federal spending and hiring. That’s already chilling long-term investment in infrastructure, education, and public research, while adding to economic drag.

Energy Policy Reversal

Support for fossil fuels has increased, while clean energy programs have been rolled back. This shift may impact university research programs tied to climate, energy, and sustainability — especially those reliant on federal agencies like the Department of Energy.

Pressure on the Federal Reserve

Trump and figures like Elon Musk are calling for up to two full percentage points of rate cuts this year. While the Federal Reserve remains independent, market and political pressure is building fast. With inflation cooling and growth indicators weakening, investors are beginning to anticipate that cuts could come as early as June.

March Inflation Report and Rate Outlook

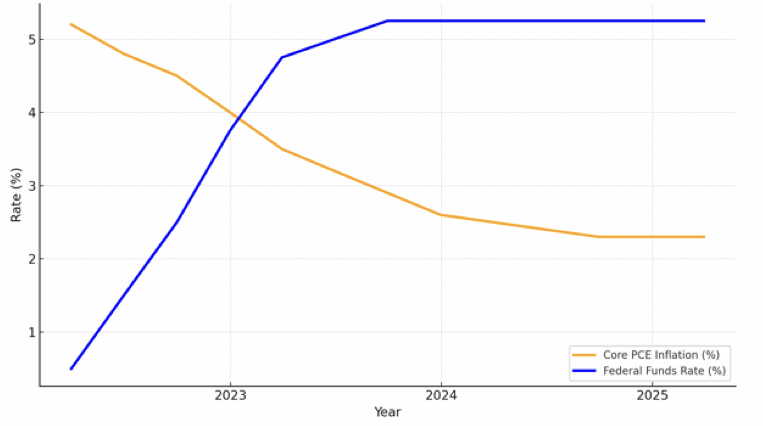

On March 29, the Federal Reserve’s preferred inflation measure — the Personal Consumption Expenditures (PCE) Price Index — showed:

- Headline PCE: 2.1% (year-over-year)

- Core PCE (ex-food & energy): 2.3%

- Month-over-month core: 0.2%

This puts inflation just above the Fed’s 2.0% target — leaving room to shift focus to employment and financial stability.

The chart above shows inflation has steadily declined since 2023, while the Federal Reserve’s benchmark interest rate remains above 5%. This growing gap raises the risk of over-tightening — especially as other indicators begin to soften.

Job Market Warning Signs

AI Efficiency Is Slowing Hiring

A March report from PricewaterhouseCoopers found that 43% of large companies are using AI in daily operations, and 60% have already reduced or paused hiring due to automation efficiencies. This is slowing job creation without increasing unemployment — a quiet but significant shift.

Graduating Students Face a Tougher Market

- Job postings for the Class of 2025 are down 8% year-over-year.

- Over 40% of MBA students graduating this spring have no full-time offer yet

Sources: NACE, GMAC

These early-career hiring slowdowns could affect broader consumer spending, housing activity, and savings rates — particularly among young professionals.

Penn State: Budget Recovery, but New Uncertainty

After years of cuts — including a $150 million shortfall, hiring freezes, and campus consolidations — Penn State University has made progress stabilizing its finances.

However, continued uncertainty in Washington could disrupt federal research support, particularly for grant-heavy departments like engineering, health sciences, and sustainability. While 2025 enrollment is projected to rise, and no new cuts have been announced, university planners are watching federal signals closely.

What’s Next: Key Dates and Signals

- April 15 – Retail Sales Report

- April 30 – Federal Reserve Rate Decision

- June 11 and July 31 – Prime opportunities for potential rate cuts

If the jobs report confirms weakness, the Federal Reserve could begin cutting by early summer — possibly setting the stage for a market rebound, even amid political and trade headwinds.

Conclusion: Tactical Risk or Strategic Bet?

What is unfolding now goes far beyond standard policy shifts — it is a calculated economic maneuver built on timing, stimulus, and political leverage. From aggressive tariffs to fiscal restraint, and now mounting pressure on the Federal Reserve, the Trump administration may be engineering a short-term economic dip to unlock substantial rate cuts heading into 2026. With over $34 trillion in federal debt, a 2% drop in interest rates could save the U.S. government an estimated $50–$60 billion per month in interest payments — a staggering fiscal incentive quietly underpinning the strategy. For Penn State, and for households and businesses across America, the ripple effects will be real. This is no ordinary cycle — it’s a high-stakes economic gamble. Hold on for a wild ride.

Works Cited

- National Association of Colleges and Employers. Job Outlook 2025. https://www.naceweb.org

- Graduate Management Admission Council. 2025 Recruiting Trends. https://www.gmac.com

- PwC. AI Adoption: A New Era in the Workforce. March 2025. https://www.pwc.com

- U.S. Bureau of Economic Analysis. PCE Inflation Report – March 2025. https://www.bea.gov

- Federal Reserve. March 2025 Interest Rate Statement. https://www.federalreserve.gov

- The White House. Tariff Announcement – April 5, 2025. https://www.whitehouse.gov

- U.S. Bureau of Labor Statistics. Jobs Report – April 2025. https://www.bls.gov