By Stephanie Kalina-Metzger

Matt and Edan Rhodes. Photo: Provided.

Matt Rhodes, managing director of Happy Valley’s 1855 Capital, has been deeply involved in the tech world over the years. The businessman graduated from Penn State in 1979 with a degree in physics, before earning a master’s in electrical engineering from Lehigh University and an MBA from UCLA.

After graduation, Rhodes worked on the West Coast in communications technology, spending 25 years in San Diego, Orange County and in the Bay area, where he became president of a billion-dollar semi-conductor company called Coexant Systems.

“Our team, at the time, connected more people to the internet than any other companies combined,” he said, mentioning a piece of equipment that only those of a certain era remember. “Coexant manufactured between 3 and 4 billion dial-up modems.”

At Coexant, Rhodes managed an organization of 2,000 employees, before moving on to serve as CEO of Teranetics, a first-tier, venture capital-backed, Bay Area startup, where he raised two rounds of funding totaling $45 million.

While on the West Coast, a part of his heart remained in State College, so he stayed connected to the area, serving on the Dean’s Advisory Council at the Penn State College of Science. When his two sons were accepted at Penn State, he returned to his roots to stay closer to family and keep an eye on his aging parents — but retirement could wait. What the area needed, he felt, was a way to spark ideas and fund innovation, which led him to found 1855 Capital.

Serving an underserved region

The 1855 Capital mission, according to Rhodes, is to be an early source of capital for all Penn State-related startups, especially areas that are underserved by capital sources in Philadelphia, Pittsburgh and the Lehigh Valley.

“Having an office located in State College allows us to stay closely connected to University Park’s innovation ecosystem and to the research and startup activity across Penn State’s 19 Commonwealth Campuses,” he said.

“We are striving to be a lightning rod in Central Pennsylvania to attract new talent and enable them to attract investors. Our story will be about the individuals and the young, driven entrepreneurs and CEOs who have the opportunity to change the world.”

The 1855 Capital Fund is a $10 million fund that provides seed and early state venture capital to Penn State-affiliated startups.

“As a manager of technology, you are always wanting to get to the next new thing and 80% of the research and development activity in the United State is in companies who are, or were, venture-backed. Venture is the laboratory of the United States economy,” said Rhodes, ticking off such well-known names as Google, Hewlett Packard, Amazon and Oracle.

Rhodes pays particular attention to Penn State campuses located in Harrisburg, York, Mont Alto, Dubois, Erie and Altoona. “This isn’t a place where the infrastructure of business is easily accessible,” said Rhodes, noting that the core issues rural areas have is a lack of local, early-stage capital, followed by a dearth of influence and strong networking capabilities.

What 1855 does, according to Rhodes, is provide necessary funding, then work with college faculty, staff, students and Penn State’s vast and powerful alumni network. “Exceptional ideas are then paired with a capable and committed management team that guides the way to high-quality investment opportunities,” said Rhodes.

1855 Capital currently partners with Ben Franklin Technology Partners of Central and Northern PA, the State of Pennsylvania, Pennsylvania State University, the Penn State Alumni Association and 50 Penn State alumni.

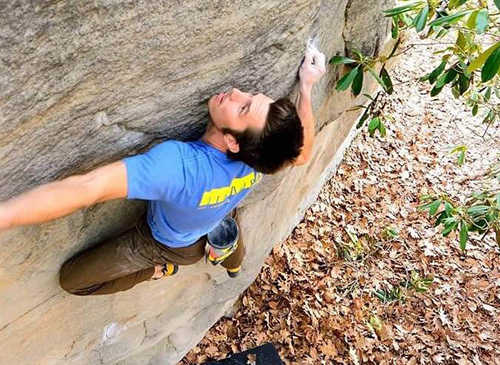

Matt Rhodes and son, Chase. Photo: Provided.

An impressive track record

One of 1855 Capital’s first investments was Phospholutions, known as a leader in fertilizer technology. Rhodes said he met founder Hunter Swisher when he was an undergrad. “He did the work and developed a viable business plan,” said Rhodes.

In August of this year, Phospholutions announced additional investment from leading global agricultural companies totaling $10 million. “It’s all about creating value,” explained Rhodes, noting that if there’s one challenge 1855 Capital has, it’s attracting great entrepreneurs to create long-term value. “Swisher did that; he created value and returned gains to the investors,” added Rhodes.

Another startup Rhodes mentions is Studio Bee, which is focused on institutionalizing mindfulness for small and medium-sized companies. “The CEO there is deeply invested in mindfulness across the globe and makes experts accessible through a subscription service,” Rhodes said.

Another company in the 1855 portfolio is spotLESS Materials, started by a Penn State professor and his graduate student. “They’ve studied nature and learned why frogs are waterproof and now there’s a world of applications to go after,” said Rhodes, adding that the company won a Gates Foundation challenge for new types of toilets that preserve water. “It turns out that toilets with the coating can clean with a lot less water,” he said.

These are just a few of the companies that Rhodes said he’s proud to have been a part of. As for the future, Rhodes said that 1855 Capital will continue to provide seed funding for the next big thing.

“We are striving to be a lightning rod in Central Pennsylvania to attract new talent and enable them to attract investors. Our story will be about the individuals and the young, driven entrepreneurs and CEOs who have the opportunity to change the world,” he said.

Do you have an idea that you think could be the “next new thing?” If so, feel free to share with us here.