Prior to forming Nittany Strategic Solutions in 2020, founder Steven Koval held a long-standing career as a senior financial executive. Now, as an entrepreneurial strategic business advisor, he utilizes his extensive experience as a CFO and in Mergers and Acquisitions to drive performance and improve his clients’ profitability, cashflow, access to capital and resulting enterprise value.

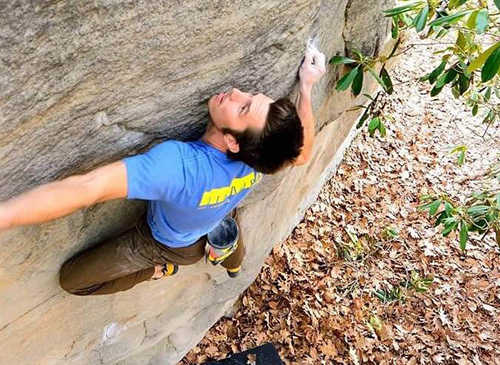

“Having worked with privately held business owners, I recognized that one of the major stress points in their lives relates to the financial aspects of their business caused by the lack of cash flow or inadequate financing,” Koval said. “I formed Nittany Strategic Solutions…to improve the lives of business owners by understanding their unique goals to grow their company. To accomplish this objective, I remove barriers that get in their way so they can rise to new heights.”

Happy Valley has proved to be the perfect location for Koval, a Penn State alum, to grow the relatively new venture.

He explained, “Given the entrepreneurial ecosystem that has developed here in Happy Valley with the support of Penn State over the last decade or so, there are a growing number of emerging companies. As companies emerge, the stress levels associated with the lack of profitability, cash flow and access to capital can become overwhelming and may cause companies to fail.”

He explained that many businesses in the area also lack the strategic advice of an experienced CFO, with in-house accounting staff too busy or focused on processing transaction, while local or regional accounting firms focus on things like tax returns, rather than how to improve a company’s profitability and cash flow.

Koval further explained of his process: “To learn as much as possible about a potential client’s business, my service begins with a complimentary Strategic Gap Analysis to assess the needs, challenges, wants and opportunities of the organization. This includes interviews with the business owners and other key management and financial staff who may all have their own unique perspectives. I have developed long-term trusted relationships with all my existing clients as they consult with me on any financial decisions related to their company.”

Still, he said that he continues to be surprised that many prospective business owners he meets with do not have the financial systems in place to generate accurate monthly, quarterly or annual financial statements. Nor do they prepare any cashflow forecasts or annual budgets so they can strategically plan for the growth of their company.

“I want to continue to understand [clients’] unique goals to grow their company and help them remove barriers that get in their way so they can rise to new heights.”

“As such,” he said, “on just about every new client, my initial focus is to improve the financial reporting systems by implementing the business processes and training their staff to generate accurate monthly financial statements. All along, I’m educating the business owners so they fully understand their financials, focusing on cashflow and profitability. In addition, due to my extensive relationships with many of the local banks and other financial institutions, I have been very successful in securing the appropriate financing to grow their business.”

That said, not every business owner admits they may need help on this critical financial aspect of their business. Many entrepreneurs are wired to solve issues on their own. However, when Koval can guide a client through maximizing their enterprise value to successfully exit their company, or can help a client secure appropriate financing to grow their company, that’s what he calls the most rewarding part of his work.

Looking to the future, he said, “My business goals are to continue to develop new clients both here in Central Pennsylvania and Naples, Florida. I want to continue to understand [clients’] unique goals to grow their company and help them remove barriers that get in their way so they can rise to new heights.”